Are you thinking of taking your first steps in the short-term rental market? In this guide you will learn what you need to be aware of when it comes to how to start a short term rental business.

1. Location, location, location!

When starting a vacation rental business, choose your property location very carefully! You really do not want to be stuck with a property in an area that everyone is trying to avoid, or an area in decline. Smart investors take a careful look at this.

Here is a useful checklist to help you decide if a location is likely to bring you the expected rental profitability…

- Rental values are on the rise – speak with local real estate agents

- The area is being redeveloped – check the town registry & planning office for any rejuvenation plans

- Good transport links – check existing and new ones being planned. Pay attention to the timing of any new links.

- Cultural appeal – make sure there are plenty of local amenities nearby such as restaurants, cafes or pubs, cinemas, sports centres, boutiques or shopping centres, or amusement parks. Also consider major points of interest such as museums, cinemas and theatres, or art galleries.

- Landscape appeal – a wonderful view, or proximity to a beautiful beach, mountain tops, a lake, a river, a gorgeous landscape or a sought-after city area – these will often raise the rentability value of your property.

- Business appeal – check the profile of local employers. Companies who are likely to bring in a lot of contractors, migrant or seasonal workers, out-of-town employees and visitors can provide an excellent short-term rental market.

- Safety – check the crime rate in the area, and check with neighbours. Also consider pollution indices such as air quality and noise pollution (proximity to railroad or airport) as these will negatively impact any rental value.

- Overdistribution – avoid areas which are particularly overcrowded with competitive accommodation – lots of other properties to rent, lots of hotels and other forms of alternative accommodation.

GOLDEN RULE #1: Location, location, location !

2. Avoid extremes and renovation bargains

If you’re just starting out, be wary of properties that require a lot of renovation – no matter how tempting their price! These properties can be full of surprises… So, unless you are adept at large scale renovations, or have a degree in plumbing, electricity, carpentry and/or masonry, steer clear of these bargain-basement opportunities as they can quickly turn into a real money pit!

For your first attempt, you should also avoid any historic building where conservation or regulatory issues can get in the way, and where even the most basic improvements can turn out to be very expensive.

Finally, if you’re starting up in the vacation rental space, you should look to buy a reasonably-priced property first. Until you get the hang of things, avoid the nicest, most expensive house in the neighbourhood, as it will undoubtedly drive higher operating costs. And avoid any bargain basement options which are likely to hide a multitude of sins.

GOLDEN RULE #2: Keep it simple. Avoid extremes and renovation money pits.

3. Financing your new venture

Unless you have a pile of savings or recently came into a lot of cash, you will probably need to take out a mortgage or a personal loan to buy the property. Especially if you’re just starting out and this is your first vacation rental.

Down payments tend to be higher for secondary residences, and the same applies to insurance costs! Therefore you should expect to have to pay between 15% and 25% of the value of the property.

Given the above, you should absolutely shop around in order to find the best available deal for your mortgage! However, interest rates can go up and down and therefore, you’ll need to make allowances for this!

- Fixed interest mortgages will cost you more but provide stability and predictability.

- Variable interest mortgages are usually cheaper but can become more expensive over time as central banks announce interest rate hikes.

Again, you really need to carefully work out the cost of your debt :–

- first, add up any existing commitments which may include a mortgage on your main house, a student loan, medical bills, or children schooling fees.

- next, add in the expected monthly mortgage repayments for your rental property.

Finally, look at all your income sources and take a conservative estimate of the rental income you expect to earn from your rental property. At a minimum, your income sources should cover the cost of your debt plus a minimum cash safety cushion. If not, then this may not be the best time to start a vacation rental business!

GOLDEN RULE #3: Always keep some cash aside as safety cushion.

4. Should you buy the place outright, borrow, or rent ?

If your first vacation rental is part of your main residence, this will obviously reduce your financing costs and increase your cash flow – the easiest way to start, but you have to be prepared to sacrifice some of your privacy instead!

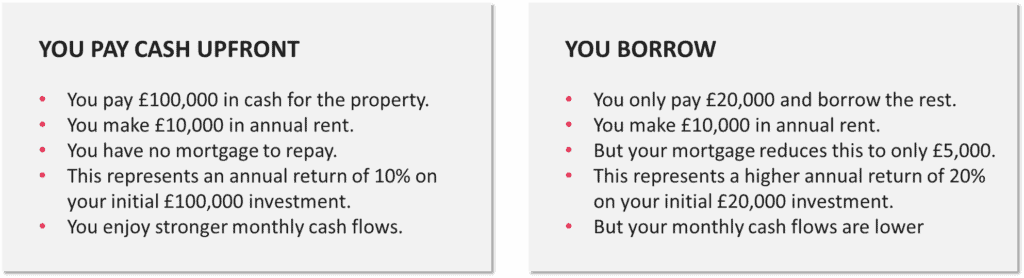

On the other hand, if you are looking to acquire a new property and you are lucky enough to have a choice between buying the place outright, or taking out a mortgage, here are a couple of things you should consider.

Paying for your rental property in cash will reduce your debt and monthly outgoings, and generate stronger monthly cash flows! The main risk however, is a declining property value leading to negative equity. To avoid this, you must pick the property’s location very carefully.

On the other hand, taking out a mortgage, can be the smart thing to do, especially if interest rates are particularly attractive. This will reduce your cash outlay and therefore bring you a higher return on investment.

Lastly, you could choose to rent or lease the place long-term and cover your rental or leasing costs with short-term bookings, as these command a much higher price. This option can be fraught with risk and complications if you have not secured all the relevant permissions from the leaseholder. Furthermore, it is the more expensive option since rental and leasing costs are usually much higher than the cost of a loan or mortgage. And remember that, at the end of it all, you will not acquire any equity ownership in the property.

GOLDEN RULE #4: Your return will be higher if you borrow-to-buy. While rent-to-rent is a risky business!

5. Take out an insurance and plan for the unexpected!

No one likes to pay for vacation rental insurance – but hey, you must protect your investment! There is always the unexpected! Shop around to find the best price and look for insurers who are able to combine building and content insurance with landlord insurance.

So, choose your insurance carefully and look closely at “exclusions” to see what is covered or excluded. Many insurances include limitations related to weather or natural catastrophes, unless you pay a higher premium. If you buy an insurance with such limitations, then it is advisable to build a cash reserve to cope with unexpected repairs, like flood damage.

If you live some distance away from your vacation rental, choose an insurer with a strong track record in dealing with claims swiftly! This can make all the difference and might be worth a small premium.

GOLDEN RULE #5: Insure your property – better safe than sorry !

6. Understand occupancy and your booking forecast

As you prepare your business plan, you need to evaluate what your rental income is likely to be. And to do this, you need to setup a best-case and a worst-case booking forecast.

Your booking forecast is driven by your expected occupancy – that is how many days a year you think you’ll be able to rent your property to a guest ?

If you rented a property 365 days per annum, your occupancy would be 100%. But of course, one rarely ever achieves 100% occupancy because it is very hard to avoid small gaps in between short-term stays. Therefore, as a rule of thumb, you should assume 50% occupancy across the year. Of course, the occupancy rate can rise to 70%-80% in periods of high-demand (holidays, special events) and drop to 30-40% in periods of low demand.

If you are just starting out, ask around! Neighbours or local real estate agents can provide a good barometer for demand. Alternatively, you could check local hotel rates – another good clue on any likely demand seasonality.

Golden rule #6: Your Rental income = 365 days * occupancy % * your nightly rent.

7. Understand your profit margins

If you are starting out, you should aim to secure a 10% return on your investment.

Your profit margin is basically your vacation rental income minus all your operating costs, expressed as a % of your income, including the cost of repaying any loan or mortgage.

The best way to do this, and, at the same time, test the feasibility of your new venture, is to analyse your costs, and build a small “reserve” for unexpected incidents as discussed earlier.

Once you understand your monthly cost base, you need to set your rental price to be high enough to cover these costs, and still leave you with a profit margin equal to 10% of your original investment.

For example:

- If you have invested £100,000, and you expect an annual return of 10%, this would be £10,000

- And let us say that your annual operating costs amount to £6,000

- Your rental revenue needs to cover your costs and deliver the expected return so this would be £16,000

You can now test whether or not this is realistic:

- If your expected occupancy rate is 50%

- There are 365 days * 50% = 182.5 nights that you can rent out.

- Your rental price for each night would need to be £16,000 divided by 182.5 nights = £87.67 per night or £613 per week for longer stays.

Compare the outcome to the price charged by other vacation rentals in the area, and see if it is competitive enough. Be careful not to price yourself out of the market as this will result in less demand, lower occupancy and less revenues!

Golden rule #7: set prices high enough to cover your running costs, but don’t price yourself out of the market!

8. Check the red tape!

Rental owners need to understand any applicable short-term rental regulations in the area.

It’s important to understand, for example, any regulation applicable to damage deposits, minimum or maximum stay requirements to see if you qualify as a short-term rental business, and the applicable taxation regime (check local, state, federal and government taxes). And do not forget your health and safety obligations (for example the need to provide children protection for your pool, or install fire alarms etc.).

Make sure you have all necessary permits and licenses, and, if your property is leased, make sure your leasehold allows you to offer short-term rentals.

Compliance with regulations may be a drain but the risk of non-compliance could be far more costly. For example, your insurance could fall through and refuse to cover the costs of an incident, if you have not complied with basic vacation rental regulations.

Golden rule #8:comply with all relevant regulations.

9. Reality check – landlord or handy man ?

One of the primary responsibilities of a landlord is to ensure that the property is sound, and that all utilities and facilities are in full working order! Properties need to be maintained, and any successful rental activity will bring with it a lot of natural wear and tear! So, you have two choices only really:

- Buy a fancy toolbox and take a night class in masonry and plumbing!

- Build up a cash reserve, and use it to set up a network of competent workmen that you can hire for each job

Or do both, to varying degrees! It is reasonable to assume that the annual cost of maintaining a property is usually 1% of its value. If you are not ready to dedicate the time necessary to manage maintenance and repair tasks, you may not be well suited to a career as a host or landlord.

Again, lucky you if you’re thinking about renting part of your main residence (an annex, a barn, an apartment or maybe even just a room or suite), as your repair burden will largely be absorbed in your house’s normal running costs. A good way to start for beginners!

Golden rule #9: be prepared to repair!

10. Get organised, be patient and realistic!

Lastly, a final piece of advice: whatever you do, be realistic in your planning and expectations.

First off, get organised – especially when you consider how to manage bookings, guest changeovers and cleaning !

Next, as a beginner, you should be conservative in your planning, and avoid disaster by making absolutely sure that you do not invest in the wrong property!

And finally, above all, learn to be patient! It may take a little while before you get into the swing of things and see profits roll-in.

Golden rule #10: be patient and realistic!