Collect any amount, from any source, at any time

– securely and automatically.

See how these businesses go further, faster,

with eviivo Suite

Alison, Property Management Company Owner, United States

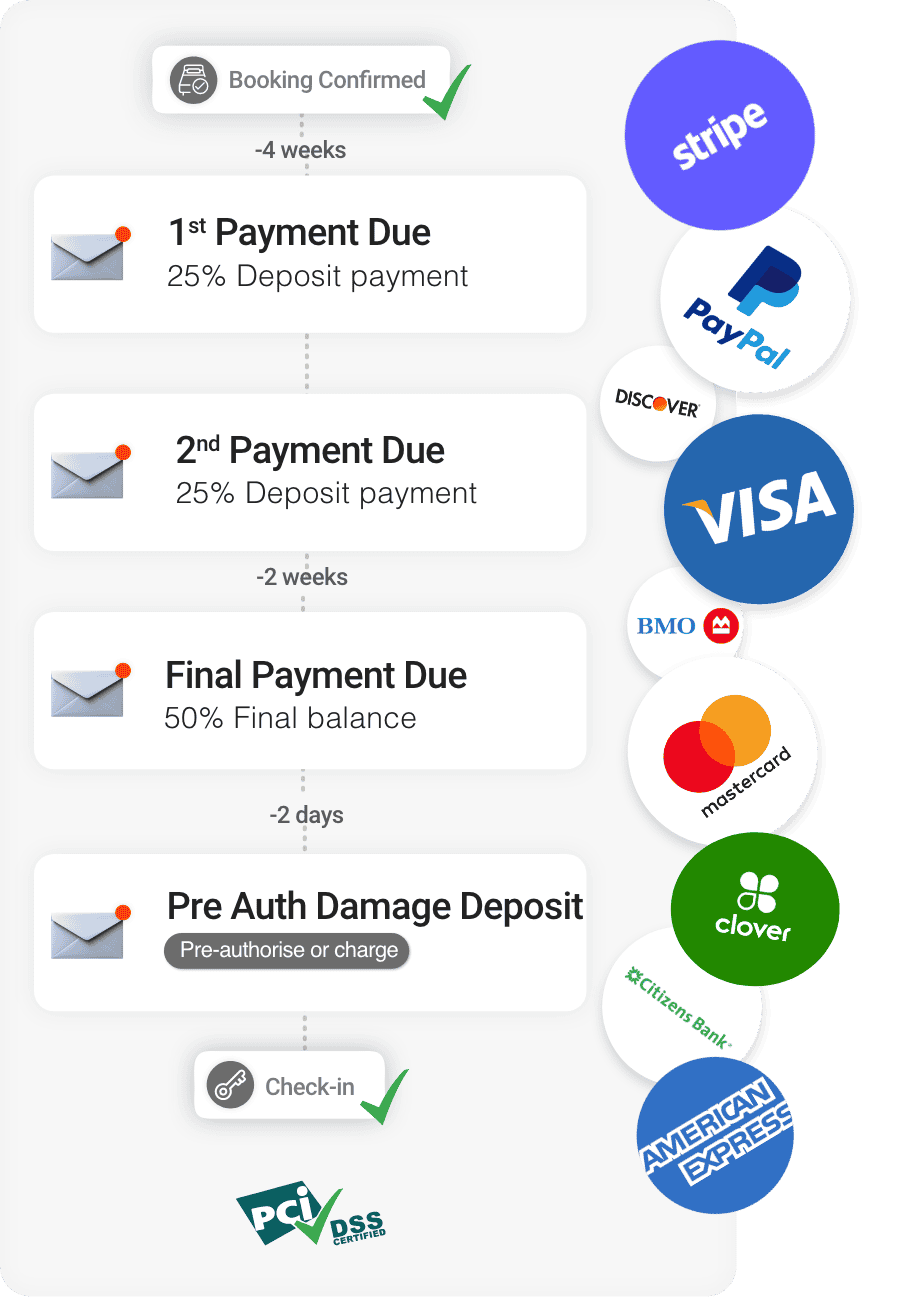

eviivo has integrations with many credit card merchants.

You are able to automate payments, so when you get a booking, you can set your deposit policy to whatever you want, and eviivo will make sure that that payment gets collected. This helps us improve cashflow by not missing payments.

Valentine, Hotel Owner,

France

With Payment Manager, I’ve gained peace of mind regarding payments. Now, when someone books through my site or an agency, their bank details are automatically entered into my eviivo system. The system checks these details for me, ensuring there are sufficient funds on the credit card and that the card is valid. This means I no longer have to worry about these issues—the system handles everything.

Laura, B&B Owner,

United Kingdom

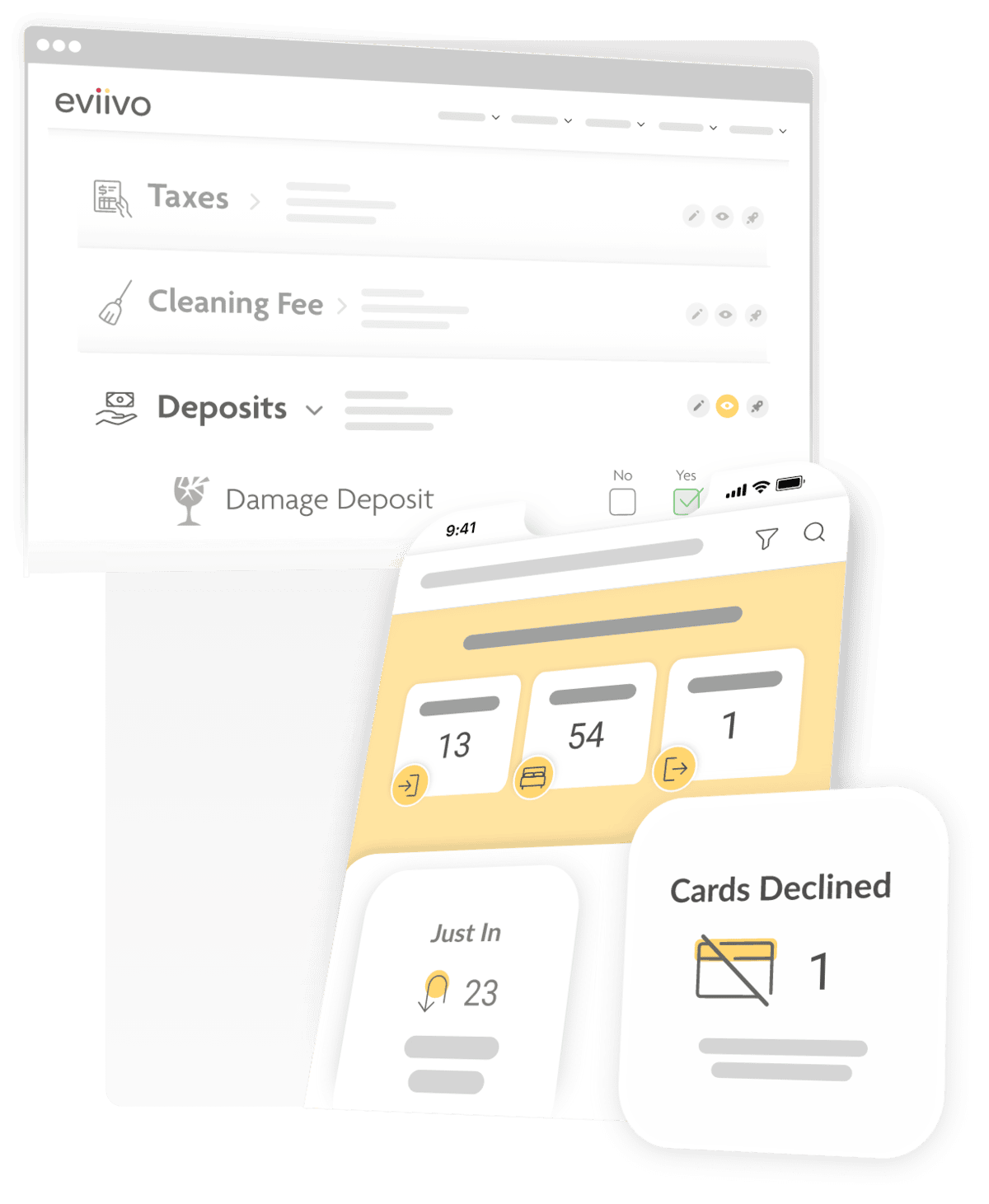

If a card is declined on the payment manager, that the eviivo can send them an automatic email, letting the guest know that, for whatever reason, it’s not working, which saves us a lot of uncomfortable conversations, kind of does the work for us.

Take charge with

automated payments

Payment processing should be smooth, not stressful. With Payment Manager software, payments flow seamlessly into your bank account.

Automate transactions regardless of booking source. It’s fast, safe and error-free – no more typing out numbers by hand! Accept payments in any currency through your website, OTAs, or via secure email links.

Take control of your cash flows and choose how and when exactly to charge guests – for bookings, deposits, extras, and other fees.

Charge or refund a card in one click …

or take payments manually.

It’s your call, always.

More options, more cash

The payment flexibility doesn’t stop there. Payment Manager supports the world’s leading card processors, including PayPal, Stripe, Worldline and CardConnect / Clover – and offers built-in support for over 500 regional banks and local service providers.

Enjoy the freedom to choose your payment processor – with no long-term commitments and greater control over merchant fees.

Guests get more choices, too. Accept payments from all major credit cards and virtual cards (Visa, Mastercard, Amex, Discovery and more), or via major payment wallets like PayPal, Apple Pay, and Google Pay™.

Protect your revenue –

and reputation

No matter how or when you collect payments, rest assured all transactions are 100% secure. eviivo’s integrated payment engine is natively compliant with PCI-DSS and 3D Secure for total peace of mind.

Save time securing bookings and damage deposits with automated pre-authorization. You’ll avoid the hassle of unnecessary refunds while reducing chargebacks and

card declines.

(And if a card is subsequently reported as expired, stolen, or declined for exceeding its credit limit? Our system flags it fast,

so you can take action right away.)

Give guests what they want

Payment Manager doesn’t just mean quicker payouts and time saved for your team – it also creates a smoother experience for guests.

Cater to their preferences for seamless payments and contactless check-ins/outs. Give them the flexibility to pay their way. And earn their trust with PCI-DSS compliant payments that guarantee their card details stay safe.

It’s more than smooth payment processing – it’s the key to fewer cancellations, happier guests, and increased revenue.

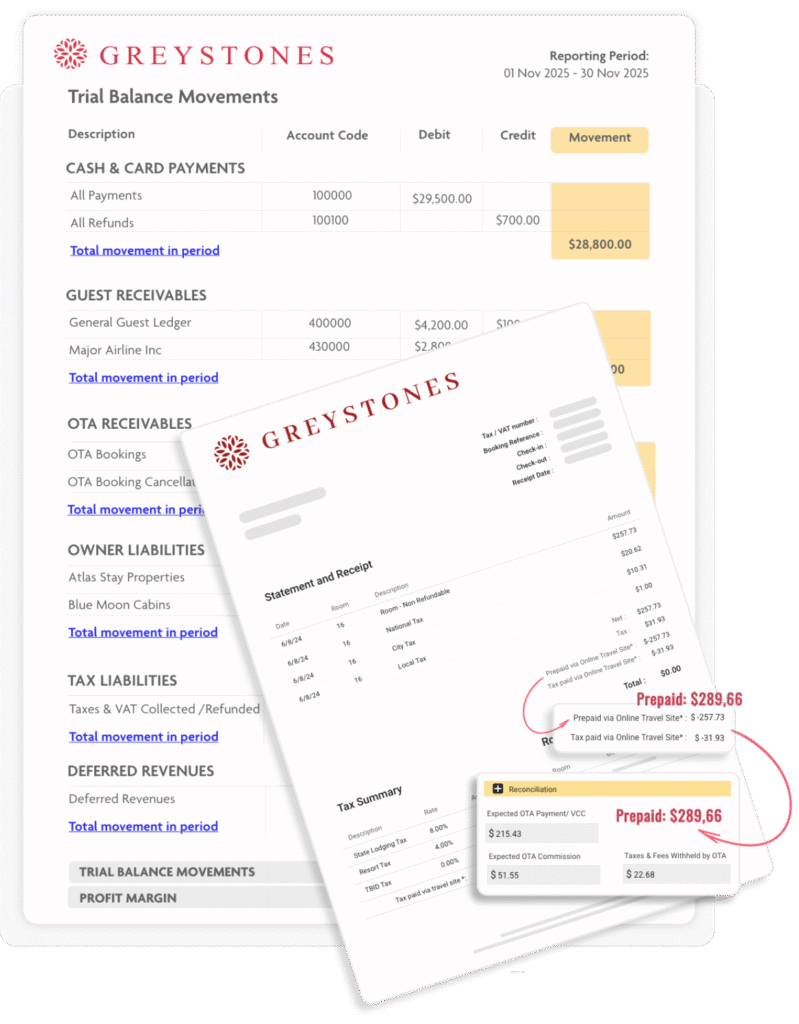

Track all transactions

in one place

eviivo centralizes all payment data for

simpler tracking, reporting and reconciliation.

Access reports to track transactions by booking source or payment method, and easily view deposits due, outstanding balances, advanced deposits and cash/card movements for any period.

Quickly reconcile payments by booking source, card type or OTA channel, and reconcile OTA payouts by VCC or direct bank transfer.

Optionally provide guests with statements that itemize every aspect of their stay and credit their bill automatically for any amount prepaid via an OTA – at the guest price – no need to ever disclose wholesale prices.

Improve compliance with a system that records advanced deposits as deferred revenues, automatically releases them to revenue from the day of check-in, and instantly updates accounting entries based on the timing of collections and refunds.

Read our white paper on how to protect your cash:

Payments, chargebacks and fraud prevention

| Payment Manager highlight | How it helps you |

|---|---|

| Automate payments completely and/or schedule automated payment requests via email, SMS or WhatsApp at set times. | Improve your cash flows by collecting any amount at exactly the right time. |

| Set different payment schedules for bookings, extras, advanced deposits and other charges or fees. | Create custom payment flows that work best for your business. |

| Secure damage deposits through automated pre-authorization. | Avoid the hassle of unnecessary guest refunds. Save time. |

| Payment transactions are subject to the most stringent PCI DSS and 3DS-2 compliance checks. | Operate with absolute peace of mind. |

| Connect to your preferred card processor or to your local bank from a wide range of options. | Avoid long-term commitments. Control merchant fees and deposit requirements. |

| Immediate notification to you / the guest / the OTA whenever a card is declined | Minimize no-shows and chargebacks. |

| Reconcile payments by booking source, card type or OTA channel. | Spot anomalies faster. |

| Collect payments manually if you prefer. | Total flexibility. Absolute payment security. |

Great rates!

We’ve pre-negotiated some terrific deals

on your behalf with major merchant banks.

Payment Manager Key Features

Save time with PCI compliant payment management and reporting.

Go Global

Process card payments from guests around the world, in any currency, for contactless check-in and check-out.

Multi-Channel Automation

Fully automated payment collection, regardless of the booking source. Handles cards supplied online, over the phone, or via OTAs.

Hassle-Free Collection

One-click to pre-authorize, charge or refund a card. No need to retype numbers and codes. Full automation: just set it and forget it!

Safe and Secure

Free PCI compliant card storage and retrieval. Automatic validation via 3D secure.

Card Decline Alerts

Invalid cards are flagged and easy to spot in eviivo Suite, so that you can deal with them quickly.

Quick Card Resolution

Cards supplied by OTAs are re-validated systematically. If invalid, a new card request is instantly issued to the guest and the OTA.

Instant Confirmation

Automate and personalize payment confirmation emails and/or messages.

Improved Cash Flow

Payments flow directly into your bank account, with card fees held at source.

One Statement, One Payment

Consolidate the management and reporting of all bookings and commissions, wherever they come from.

Payment Gateway Flexibility

Choose from Stripe, PayPal, CardConnect/Clover, Intuit and Worldline (including Ingenico and Bambora).

More Ways for Guests to Pay

Accept payments from Visa, Mastercard, Discovery and Amex, accept virtual cards, PayPal, Apple Pay, Google Pay, and more.

Custom Payment Flows

Set your preferred payment schedules for bookings, extras, damage deposits, and other charges / fees.

Payment Manager Wins!

- Really simple, whatever the size of your portfolio

- Out with the tedious, in with great guest experiences

- End card decline miseries, regardless of source

- Scale faster with timely, accurate automation

- More cash quicker

FAQs

Can eviivo Suite reduce failed payments, chargebacks, and fraud?

Yes. eviivo Suite is designed to protect your revenue as well as your guests.

Payments are processed under full native PCI-DSS Level 1 and 3DS-2 compliance, helping to authenticate cardholders properly and reduce chargeback risk. If a card fails, eviivo flags it instantly and can automatically prompt the guest to provide an alternative payment method (before arrival, not after a no-show).

Virtual cards from OTAs are handled correctly and collected at the right time, without staff intervention. A simple visual flag instantly notifies you of the exact date when the VCC can be charged and the payment released, while a convenient “action list” displays all deposits due to help you maximize cash flows.

To minimize chargebacks, bad cards are instantly detected and declined. Additionally, if a valid card later expires, is stolen, or becomes invalid before the next payment is due, it is flagged in the system and to the OTA, and a new card request is automatically issued to the guest and the OTA.

Every payment transaction and booking is supported by a full audit trail, serving as evidence to help you fight abusive charge-backs. You can use also pre-arrival emails to collect further guest information as necessary, including copies of personal IDs or signed rental agreements.

The benefit: fewer revenue leaks, stronger fraud protection, and greater peace of mind.

Can I offer guests more ways to pay without extra complexity?

Absolutely. eviivo Suite’s Payment Manager lets you offer flexible, secure guest-friendly payment options, cutting back any admin for you, while keeping everything simple for the guest.

You can support credit and debit cards, digital wallets like Apple Pay and Google Pay, and popular direct local payment methods such as Ideal or Sofort, depending on your country and bank setup – all managed from one place and fully integrated into the booking journey.

Alternatively, you can accept bookings without any payment, and target this flexibility to specific audiences.

Either way, there’s no need to juggle multiple payment tools or dashboards.

The benefit: higher booking conversions, happier guests, and one streamlined payment experience.

How does eviivo Suite handle deposits, damage deposits, and pre-authorizations?

eviivo’s Payment Manager gives you complete control over how and when money is secured.

You can automate any payment collection or choose instead to pre-authorize cards. You can auto-collect booking deposits as and when needed, and, at the same time, only pre-authorize damage deposits at a chosen time on or before check-in.

You can also apply a different schedule for the collection of booking deposits and the payment of certain extras (e.g. cleaning fees) while allowing the guest to settle the entire balance at a time of their choosing if they prefer. Access codes and check-in instructions can be withheld automatically until the required payments are secured.

Everything is tracked clearly in the guest’s bill, statements, and reports – and you can automatically send them professional customizable confirmations or reminders at every step.

The benefit: reduced risk, fewer disputes, and fully automated enforcement of your payment policies.

Will eviivo’s Payment Manager simplify invoicing and OTA reconciliation?

Yes. Invoicing and reconciliation are built into the same workflow as payments.

eviivo generates branded, customizable and compliant guest invoices and statements, clearly showing what was paid or prepaid via an OTA, and what’s outstanding. Preferences ensure that guest invoices and statements clearly display the amount prepaid by the guest via an OTA (without disclosing your wholesale price), or they can be set to only display extras or additional on-premise spend.

Virtual card payments, commissions, and payouts are tracked and reconciled without manual spreadsheet work.

Invoices can be downloaded, emailed, or exported for accounting in just a few clicks.

The benefit: faster month-end close, cleaner accounts, and no more reconciliation headaches.

Does eviivo Suite integrate payments with the rest of my operations?

Absolutely. Payments aren’t bolted on; they’re fully embedded into the eviivo Suite platform.

Your bookings, guest communications, cancellations, refunds, invoices, and reports all stay perfectly in sync. Payment events automatically trigger confirmations, reminders, refunds, and access control without duplication or manual steps.

The benefit: one connected system, fewer tools to manage, and a smoother experience for both staff and guests.

Free open access to APIs

And no lock-in. If you can’t find exactly what you want within eviivo Suite, we provide an extensive range of APIs, anytime, at no cost, to integrate the platform seamlessly within your environment.

We offer a multitude of APIs and webhooks in

the following areas:

Get access to out-of-the-box iCal connectivity, a custom report writer, a WordPress plugin, and a marketplace of over 200 partner integrations.